california mileage tax bill

The bill would require that the pilot program not affect funding levels for a program or purpose supported by state fuel tax and electric vehicle fee revenues. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs.

Why It S A Bad Idea To Tax People For Every Mile They Drive Grist

Traditionally states have been levying a gas tax.

. California wants to tax your road mileage. October 1 2021. Workers who use their personal vehicles for business purposes will have to track their mileage.

This pilot program which allows California to explore charging based. Please contact the local office nearest you. The California legislature passed a bill extending a road usage charge pilot program.

California Expands Road Mileage Tax Pilot Program. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg. The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as specified.

Exploring the state of a motoring California. This means that they levy a tax. Instead of paying at the pump when purchasing fuel a mileage tax system determines a drivers vehicle miles.

Sacramento The California State Board of Equalization BOE will hold its annual Taxpayers Bill of Rights Hearing on August 30 2022 scheduled to begin at 1000 am. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

Taxpayers and stakeholders are invited to attend in person participate by phone or submit comments online on items. Posted on January 10 2021 1101 pm. For questions about filing extensions tax relief and more call.

California has announced its intention to overhaul its gas tax system. Online videos and Live Webinars are available in lieu of in-person classes. This means that they levy a tax on every gallon of fuel sold.

Senator Wiener Introduces SB 339 to Extend Californias Road Charge Pilot Program Providing a Potential Future Source of Transportation and Road Funding. This money helps keep both local roads and state highways in good repair. On average Californians pay about 280 a year in state gas taxes that are charged at the pump when a driver buys gas.

Other state fees also fund transportation and some counties also charge a local sales tax to further invest in road and transit needs. Californias Proposed Mileage Tax. As of Aug.

The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under state legislation proposed by a Bay Area lawmaker. For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile. They then report the number of business.

The money so collected is used for the repair and maintenance of roads and highways in the state. The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as specified. 10 They both increased the reimbursement rate 4 cents from the first half of 2022.

California state and local Democratic politicians are trying to implement a Mileage Tax on all drivers by 2025. The average Prius owner would pay the state 11666 the difference between the 19443 in road usage taxes and the 7770 in gas taxes while the average F-150 owner would get a 2160 rebate the difference between the 21603 in gas taxes and the 19443 in road usage taxes. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under state legislation proposed by a Bay Area lawmaker.

This means that they levy a tax on every gallon of fuel sold. 36 cents on diesel. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under state. At President Joe Bidens direction the federal government is currently exploring a Mileage Tax pilot program. But opponents are concerned the legislation is laying the groundwork for a permanent mileage tax.

Personal Vehicle state-approved relocation 018. CDTFA public counters are now open for scheduling of in-person video or phone appointments. Californias Proposed Mileage Tax.

In conjunction with the Boards August 2022 Meeting. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. SACRAMENTO - Senator Scott Wiener D-San Francisco introduced Senate Bill 339 the Gas Tax Alternative Pilot.

Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee. 24 California motorists pay 437 cents per gallon on gasoline taxes.

The annual road usage tax due for both drivers would be 19443.

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

A Primer On Vehicle Miles Traveled Taxation Concepts California Globe

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Everything You Need To Know About Vehicle Mileage Tax Metromile

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax

Opinion San Diego Drivers Shouldn T Be Taxed On The Miles They Drive Times Of San Diego

What Would A Vehicle Mileage Tax Mean For Ride Share

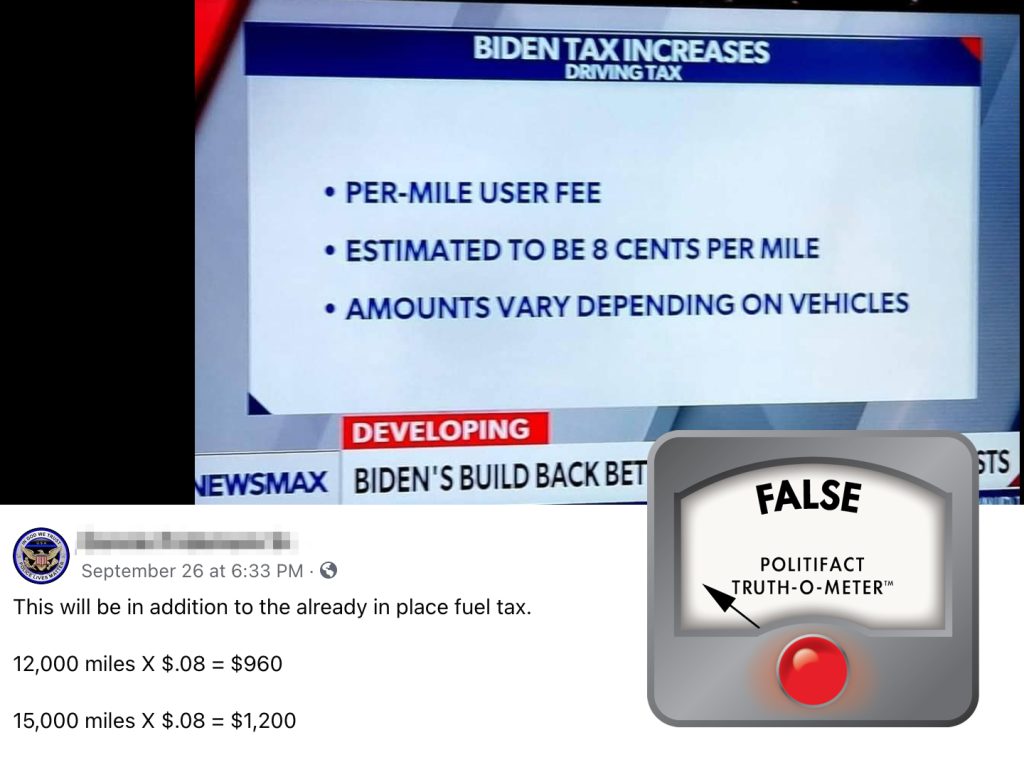

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Opinion Mileage Tax Plan San Diegans Debate Per Mile Charges For Drivers The San Diego Union Tribune

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Sandag Adds Per Mile Tax To 160 Billion Transportation Plan Proposal Nbc 7 San Diego

What Are The Mileage Deduction Rules H R Block

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com

Examining Mileage Based User Fees As A Replacement For Gas Taxes Reason Foundation

County City Leaders Push Back Against Proposed Mileage Tax

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics