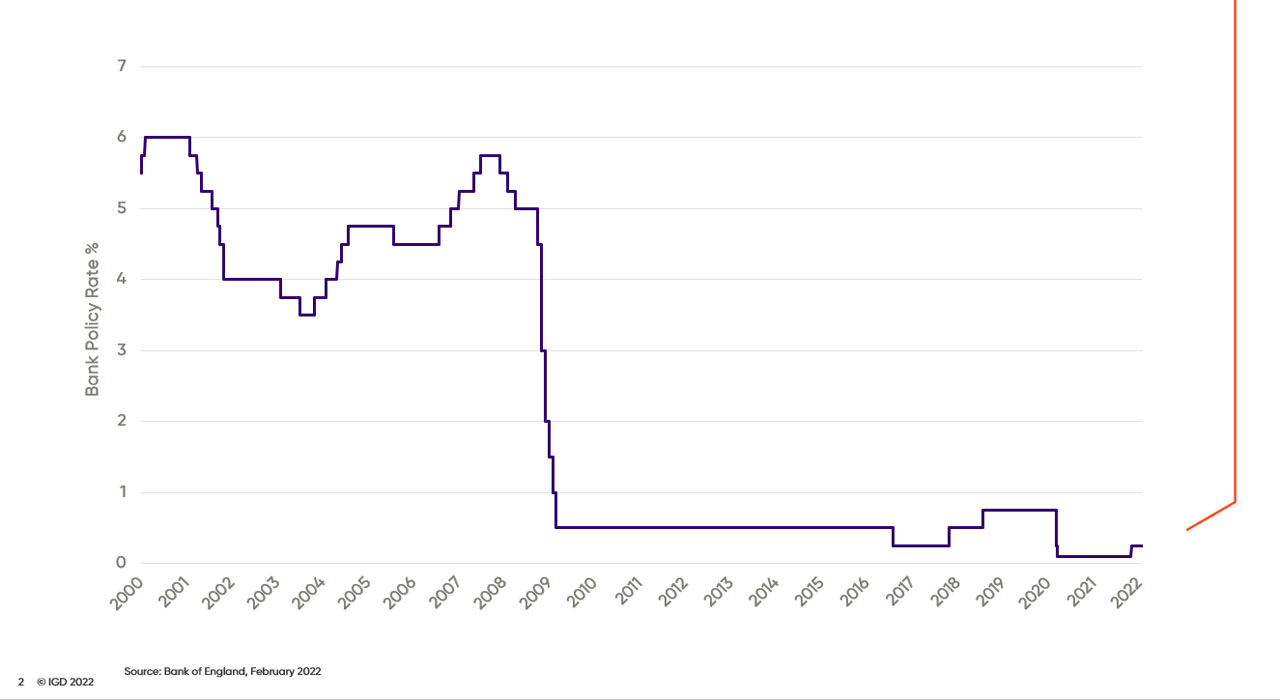

Bank of England base rate

Before the recent cuts it sat at. Over the last couple of months the central bank has consecutively raised.

Explainer Why Is The Bank Of England Talking About Raising Rates Reuters

Threadneedle Street London EC2R 8AH.

. The Bank of England base rate is currently 225. Daily spot exchange rates against Sterling. 3 despite a plummet in sterling but will make big moves in November.

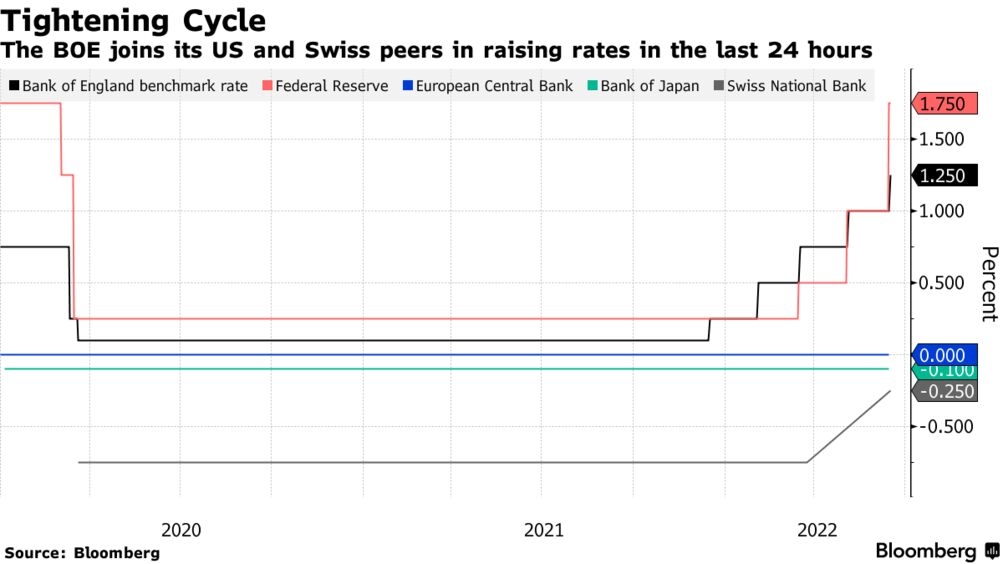

The Bank of England wont raise interest rates before its next scheduled policy announcement on Nov. The Bank of England BoE is the UKs central bank. Daily spot rates against Sterling.

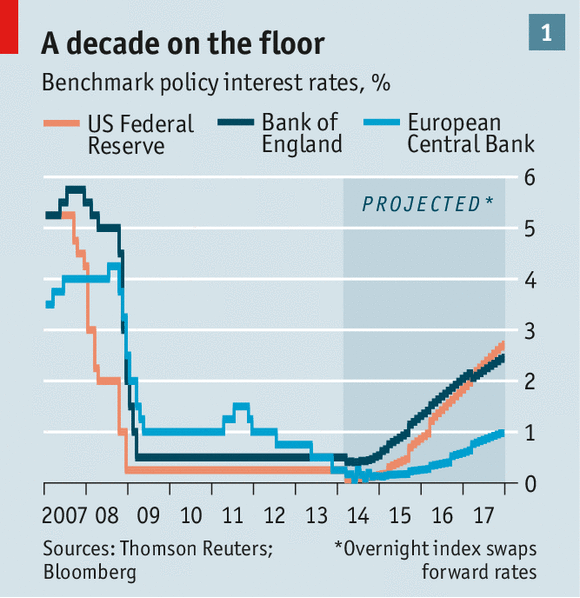

The Bank of England said rates are unlikely to rise above 5. Our mission is to deliver monetary and financial stability for the people of the United Kingdom. On 2 August 2018 the Bank of.

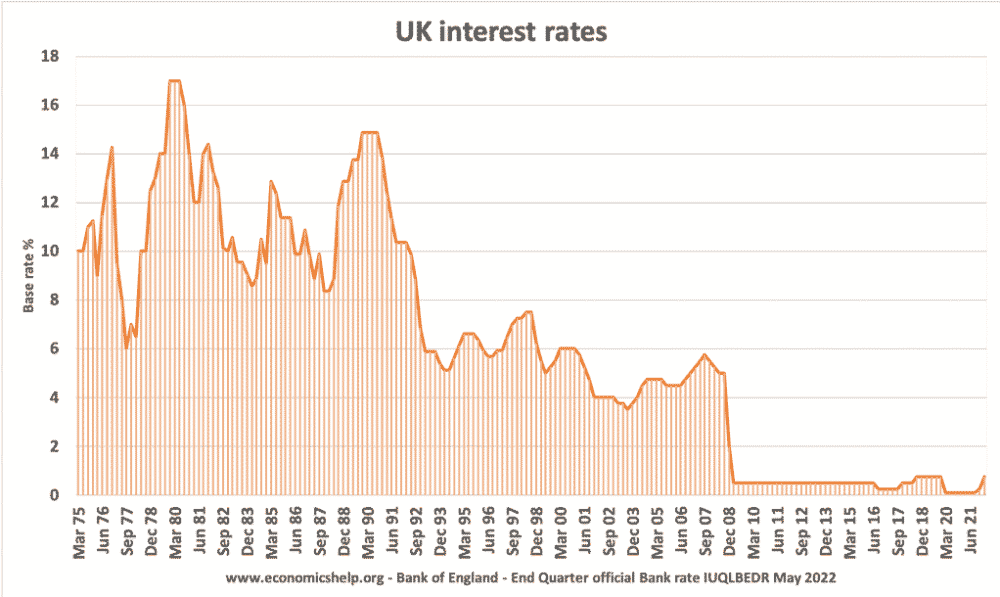

The Bank of Englands Monetary Policy Committee MPC sets monetary policy to meet the 2 inflation target and in a way that helps to sustain growth and employment. The Bank of England has increased the base rate from 175 to 225 the highest it has been in 14 years. Fears that the Banks base rate would jump by more than one percentage point above its current level of 225 have calmed.

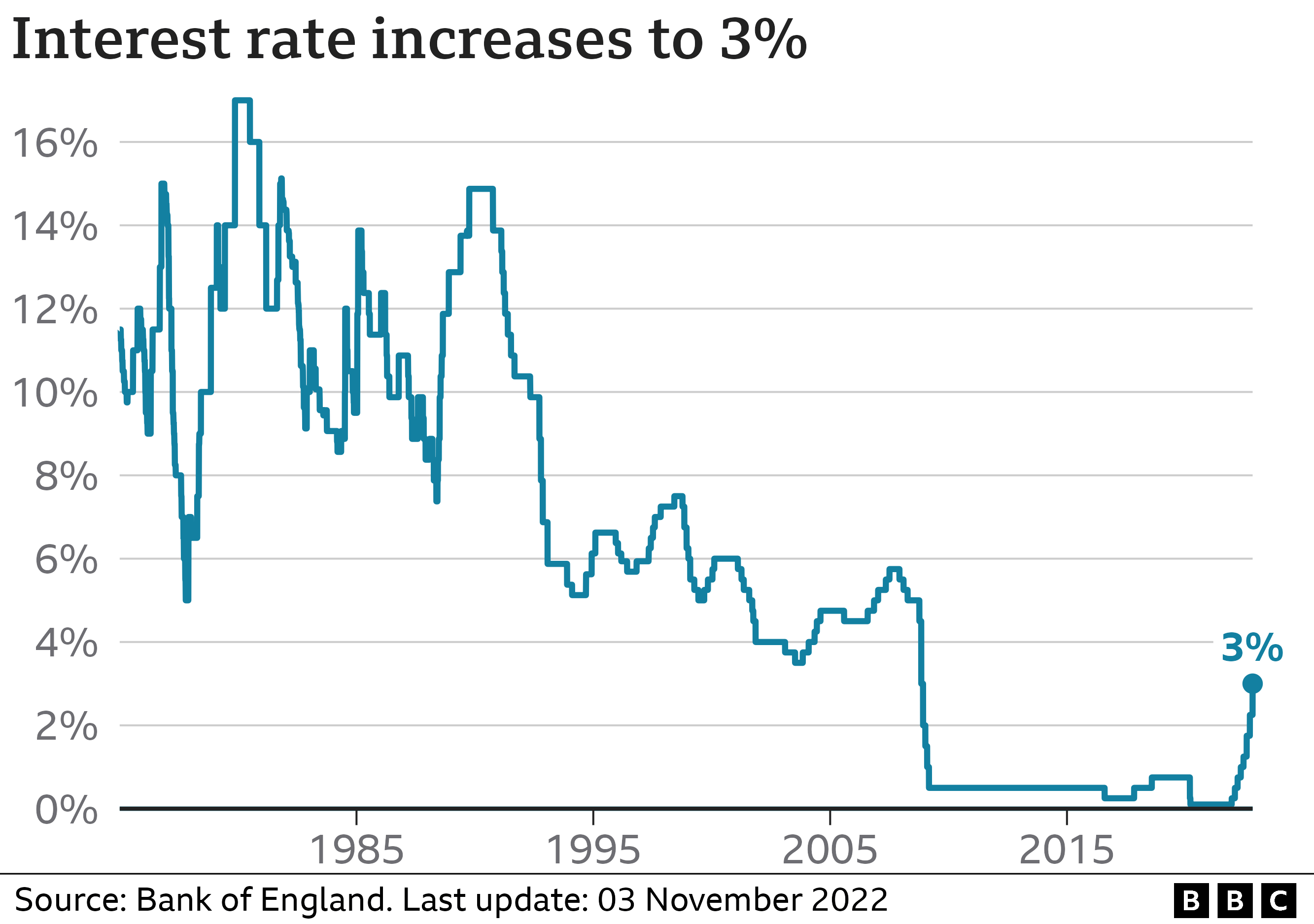

The bank rate was cut in March this year to 01. 1 day agoThe Bank of England raised interest rates by three quarters of a percentage point on Thursday the biggest hike in 33 years as it tries to contain soaring inflation even as the UK. 47 rows The Bank of England base rate is the UKs most influential interest rate and its official.

The Bank of England BoE is the UKs central bank. The Bank of England base rate is currently. If you have a problem or question relating to the database please contact the DSD EditorReference Id 16308164031.

Self Employed Mortgage Hub. Our mission is to deliver monetary and financial stability for the people of the United Kingdom. The current Bank of England base rate is 225.

The base rate dropped to an all time low of 01 following the outbreak of the coronavirus pandemic in March 2020. This rate is used by the central bank to charge other banks and lenders. In the United Kingdom the official bank rate is the rate that the Bank of England charges banks and financial institutions for loans with a maturity of 1 day.

The base rate was previously reduced to 01 on. 2 days agoWith UK. This rate is used by the central bank to charge other banks and lenders when they.

1 day agoEarlier today the Bank of Englands Monetary Policy Committee MPC met to discuss the UKs base rate. There are indications that the UK is already in recession as the Bank of England says there will be a 01 GDP decline in this financial quarter. Thu 20 Oct 2022 1027 EDT Last modified on Thu 20.

1 day agoThe Bank of England has increased the base rate from 225 to 3 the largest single rise since 1989. The base rate was increased from 175 to 225 on 22 September 2022. Inflation running at a 40-year high of 101 in September the Bank is seen hiking its main lending rate for the eighth consecutive time.

Our use of cookies. Just a week before that it was cut to 025.

Historical Interest Rates Uk Economics Help

Interest Rates Held At 0 01 But Bank Of England Warns They Could Go Negative How Would It Affect Your Finances The Sun

Boe Official Bank Rate British Central Bank S Current And Historic Interest Rates

Inflation And Interest Rates Up Up And Away

Boe Hikes Interest Rate To 13 Year High Amid Cost Of Living Crisis Daily Sabah

Bank Of England Increases Interest Rates Amid Inflation Concerns

Bank Of England Raises Uk Interest Rate To 1 25 Boe Policy Decision Bloomberg

Bank Of England Poised To Raise Interest Rates To Pre Covid Level Financial Times

Call On Bank Of England For 3 Interest Rate To Halt Runaway Inflation Business The Times

Visual Summary Inflation Report August 2019 Bank Of England